EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 10th January 2022

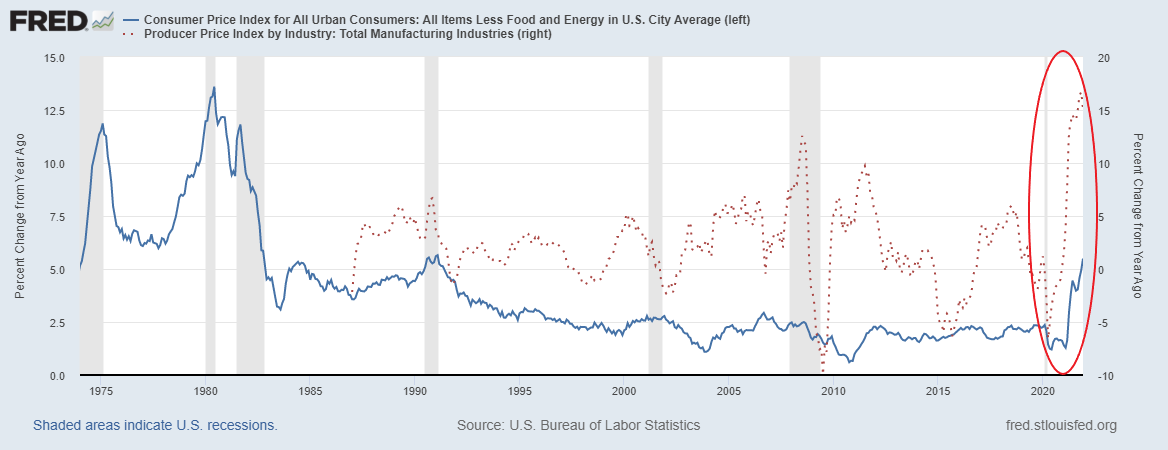

“D-Time.” Towards the end of the year, an outlook is forming in which inflation takes a prominent role. Politicians worldwide have noticeably more to say than before the pandemic. Lockdowns and quarantine regulations are leading to supply shortages, and at the same time social welfare measures and stimulus programs are expanding the money supply rather than tightening it. Added to this are climate-change measures, which are making energy more expensive and driving inflation even higher. Central banks are being forced into action and are talking about countermeasures. These would deprive stock markets of capital, and consequently nervousness is increasing. It is decision time: Do we move towards administered markets, or do we attempt to make our way back to a free market economy?

Market Review

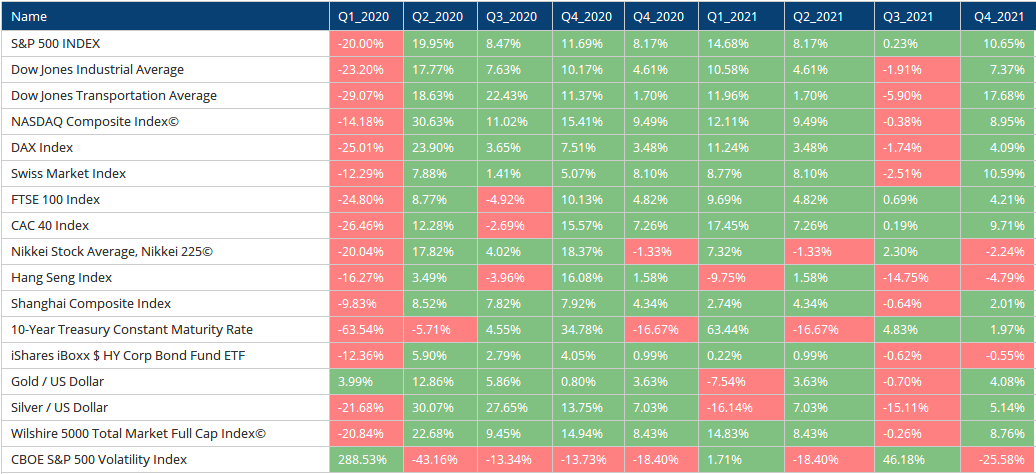

In the fourth quarter, the markets on balance performed positively. Intermittently, however the situation looked very different: In November, sentiment fluctuated and investors were risk-averse. Since then, the markets have been moving sideways, with a partial upward breakout towards the end of the year. The more defensive stocks gained some ground on the cyclicals, and in some cases also on the growth stocks, although a strong recovery began here towards the end of the year, primarily among US tech stocks. The Asian markets were somewhat more under pressure and closed in part still slightly in the red. In November, volatility reached highs last seen in March 2020 due to the tense situation, but then fell back to more cautious levels of below 20 at year-end (as measured by the US S&P500 index).

Stock markets tend to end the second quarter at the upper end of the range and the third quarter at the lower end of the range.

In terms of interest rates and capital markets, short-term interest rates have increased slightly and medium-term interest rates more strongly. The 10-year yield, however, remains virtually unchanged, and has even fallen slightly compared with a year ago. The steepness of the curve has also become somewhat flatter year-on-year.

In general it can be said that, contrary to the general perception, the capital markets do not see sustained inflation. Inflation-adjusted returns show only a minimal increase from a year ago, but a noticeably lower return from two years ago.

Some easing is seen in corporate bonds, with yields for lower-quality debtors falling slightly. Compared with the pre-pandemic period, the curve is also no longer inverse for this sector and was generally steeper in the last quarter of 2021.

The US dollar was able to break away from its lows and moved upwards in the index (more than half of the index consists of the rate against the euro, which showed weakness).

Gold caused a great deal of nail-biting among investors, with another attempted upwards breakout. For the time being it remained just an attempt, however, as in the case of silver. In the longer term, silver displays great potential for catching up with gold.

Bitcoin has disappointed to a certain extent; the hoped for “seasonal” year-end rally did not take place.

In Focus

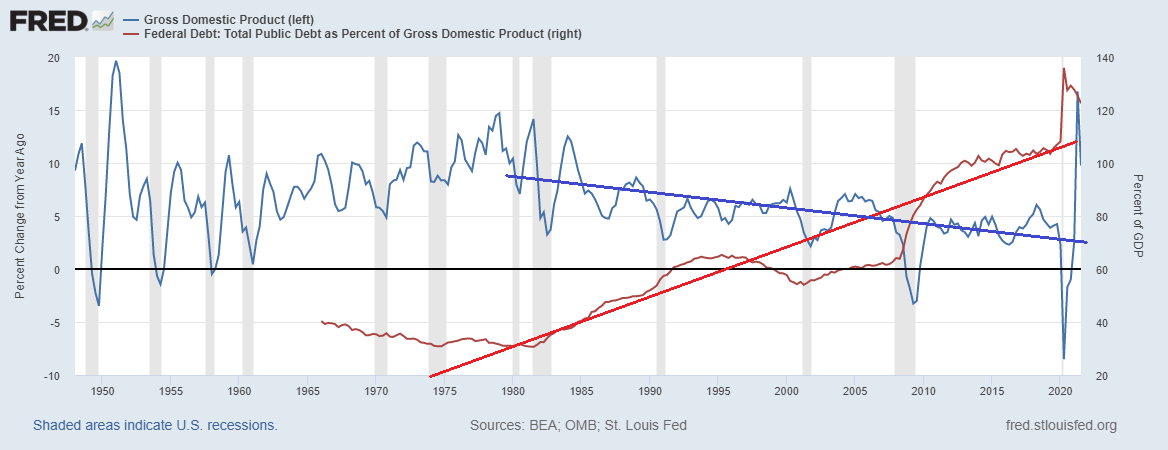

It would seem that the decision-making years have arrived. As already mentioned several times, we are seeing mountains of debt piling up while at the same time growth rates are declining. This trend has existed since the early 1980s.

The current low interest rates are probably not solely due to central-bank policy, but also to the trend toward lower growth rates (with demographic trends also likely to be a major factor). Central banks are carrying out their mandate of disinflation and combating the associated pressure on prices, but without having virtually any tools to do so effectively. As a result, we see the balance sheets of the various central banks expanding, with a concomitant inflating of asset values: The money is not finding its way into the manufacturing economy, but is finding its way into the financial industry (stocks, bonds, cryptocurrencies and NFTs, as well as into art and mortgage-financed real-estate). The theory is that with increasing debt burdens and low interest rates, commercial banks may increasingly only lend to solvent borrowers. The margin for defaults is thin.

The pandemic, lockdowns and other measures such as quarantine periods have all curtailed economic performance. The politicians who implemented these measures are now, in the face of lower production, having to absorb shortfalls in income while paying out money in the form of stimulus packages.

The decision they need to take now and in the coming years will be whether to cut debt or – more likely – to slowly “grow out” of the current situation. The latter would require negative real interest rates. If inflation proves stubborn, central banks will come under increasing pressure to raise interest rates (their mandate being price stability), thereby strangling economic growth, not least because rising interest rates also put pressure on stock markets, which in the rich consumption-driven industrialized nations play a significant role in growth.

Outlook

Stock exchanges are known to anticipate events. 2022 could therefore be a decisive year on the stock markets. If we are near the end of the impasse consisting of high debt, low interest rates and rising inflation, the actions of central banks will put downward pressure on valuations, and stock markets will undergo a correction. If, however, inflation levels off again, then low real interest rates could continue to support stock markets and valuations could also rise further.

The past decade has seen such an increase in valuations. The pandemic marked a turning point, with the economy suffering a severe slump and debt once again increasing. The issue of refinancing remains and hangs like a sword of Damocles over valuations (leveraged assets).

For investors, the choice is likely to be limited for the time being: interest rates will remain low even after the forecast rises, and money will flow into risk assets. If a price correction is imminent, the recommendation remains to opt for investments with the most solid earnings potential.

“It’s better to be approximately right than precisely wrong.” Warren Buffett

EDURAN AG

Thomas Dubach

Leave a Reply