EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 5th April 2022

“Turning point.” The conflict between Russia and the West is just the latest in a series of developments that have occurred in recent years: Supplies of vital raw materials are becoming both scarcer and more expensive; coupled with manufacturing bottlenecks due to the pandemic, this is driving inflation even higher. The consumption-based western economy is entering into a period of crisis, as are margins. As a result, market valuations have undergone a correction: Inflation has caused central banks to raise interest rates and, more importantly, sanctions against Russia could call into question the US dollar’s status as the global reserve currency. The framework of the global economy is starting to teeter.

Market Review

At the beginning of the year, Russian troops gathering on the borders of Ukraine were the main focus. Then came the anticipated interest rate hikes – up to 10 increases are expected over the course of the year. Therefore, during the first quarter, markets were cautious. Until the invasion of Russian troops into Ukraine: this resulted in a dramatic slump in prices. However, they quickly stabilized and would soon recover somewhat. However, technically speaking, the downward trend or correction was still in place at the end of the quarter. At the same time, the overarching upwards trend remains.

American markets suffered the least; European and Chinese markets experienced stronger corrections. Gold was able bounce back, albeit less than some had hoped or expected. Nevertheless, gold demonstrates its quality in uncertain times. Compared to returns, a spread emerged where, from a historical perspective, interest rates decrease, otherwise gold has to lose value.

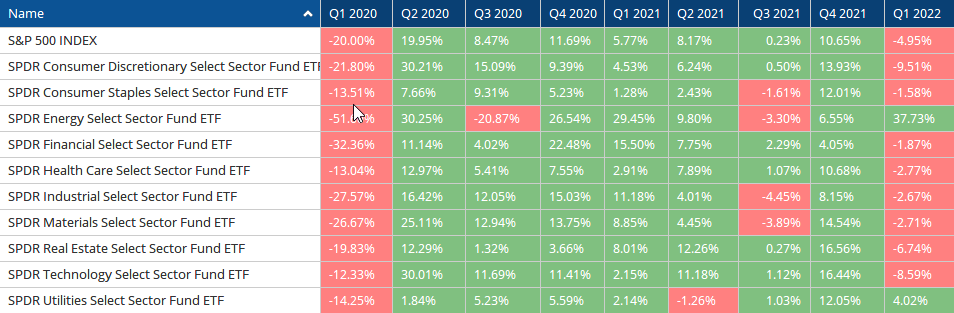

The energy sector was the best-performing sector. However, the relative strength of this sector had already emerged in the previous year.

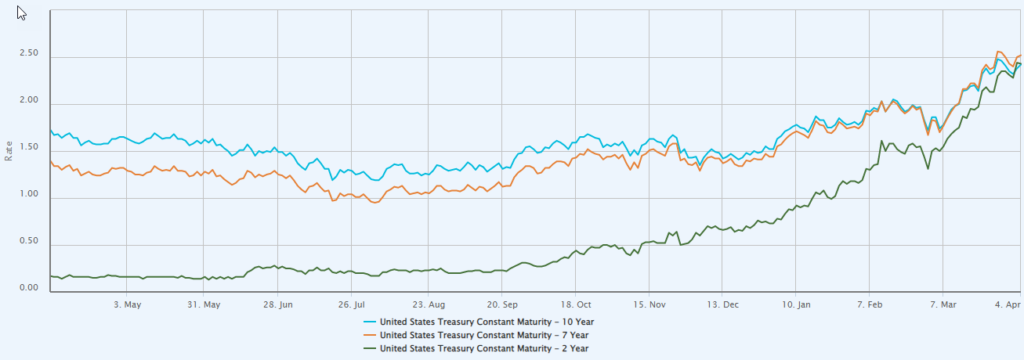

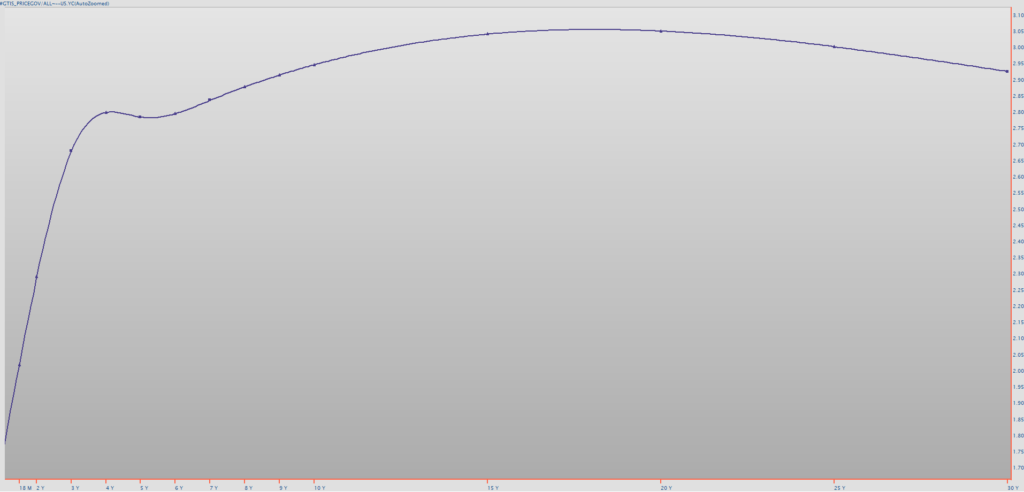

In terms of interest rates, the anticipated increases flattened the curve over the year. The seven-year interest rate for US treasury bonds (7-year Treasury Rate) recently exceeded the 10-year – an inversion that, historically speaking, is not a good sign.

Signs point to a recession. Furthermore, interest rates still remain stuck near historically low levels. Long-term rates in particular have increased relatively little, which indicates that markets are anticipating interest rate hikes, but expect them to decrease again afterwards.

In terms of currency, the US dollar stood out, gaining strength. The yen literally collapsed after already experiencing a trend reversal towards weakening before the end of the year.

Bitcoin did not react strongly to these events, and instead continued its consolidation phase with a tendency towards strength. On the blockchain, assets with longer holding periods saw an uptick in popularity, which is a positive sign from a historical perspective.

In Focus

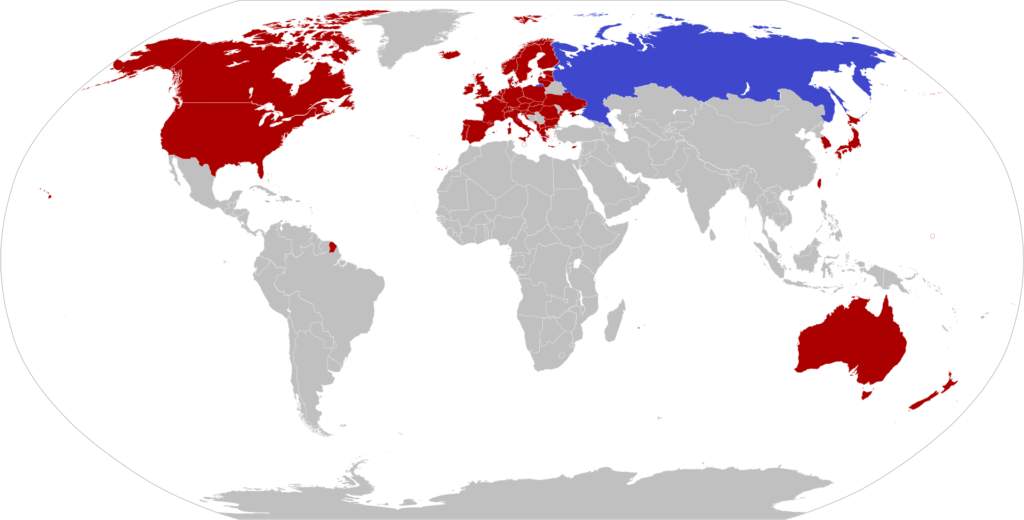

With the invasion of Russian troops into Ukraine, the framework of global markets began to teeter. However, like a foreshock before an earthquake, first all of the tension accumulated over years was discharged. Further hardship could follow – particularly economic hardship as well as on the political and societal level. Naturally, we can only hope that the military situation will not escalate further. Whereas some people seemed to be surprised at the invasion of a sovereign nation, we have now woken up to a new reality in which states pursue their interests with military means if necessary. The sanctions imposed by the West as the result of the invasion split the world into good and evil – Team USA against the rest. A little more than 30 countries with a total of just under 50% of all global economic output have imposed sanctions against Russia.

The rest is more or less staying silent. Russia is cozying up to China, moving further away from Europe and the western world, even though we have so many close ties. The sanctions are having repercussions, and other emerging nations like India, for example, will be watching the situation closely. New alliances could form. We will also have to rethink how we build reserves because, to a certain extent, the financial world (including the SWIFT system) will be used as a weapon and assets will be frozen. Since the first round of sanctions in 2014, Russia has already expanded its gold reserves compared to the US dollar and has now essentially pegged its currency to gold with the announcement that 5,000 rubles can be exchanged for 1 gram of gold at the Central Bank of Russia. Furthermore, Russia is demanding payments for oil and natural gas in rubles or, from friendly nations, in gold. Shortly before the end of the quarter, the Saudis also announced that they will be selling oil for the Chinese yuan in the future – and no longer in US dollars, as they have since 1974.

The sanctions hurt Russia, but they are also a headache at the very least for the other side. The countries that have imposed sanctions against Russia are either unable or unwilling to take them all the way: Japan is continuing its involvement in the Sakhalin-2 project, Europeans are finding it difficult to give up Russian gas supplies, and the US continues to import Russian uranium that it needs to operate its nuclear power plants.

Outlook

In such an environment, within equity allocation, we see the possibility that the losers of yesterday will be the winners of tomorrow. With interest rates picking up at the short end, we expect financial engineering where companies have bought back their own shares via credit financing, for example, to fade into the background. Boring securities with a healthy cash flow could become more popular over the medium-term.

We also need to consider the fact that as the economic situation becomes more precarious, we can expect to see state interventions. The COVID-19 situation has already shown us what is possible: governments guaranteed loans, which is equivalent to a form of printing money via fiscal policy. If prices increase more widely, this will increase pressure on politicians. For example, around 70% of Americans live paycheck to paycheck. The US administration has already responded and released part of its strategic oil reserves to counteract these developments somewhat. Members of the European Parliament are discussing further state interventions, President Macron has announced his new “France Relance” plan. In an environment riddled with so many uncertainties, the conservative approach to investing seems to be the choice of the hour in order to avoid damage and remain invested.

“Before you act, rid yourself of doubts.” Alexander Dostoevsky

EDURAN AG

Thomas Dubach

Leave a Reply